I felt that I should write another small blog post on Cisco Systems, since their quarterly financials were released today and caused over a 10% drop in the share price. I took a quick glance at the numbers and immediately felt that the market is greatly over-reacting to earnings falling short of analyst estimates. Both revenue and gross profit increased slightly over last quarter and more significantly over the year-ago quarter. Profit margins, research and development, and selling/general/administrative costs all stayed stable over the last four quarters. Net income only shrunk slightly over that of last quarter, and earnings per share stayed around the same. Owner earnings actually grew by 12% over last quarter, and there was only a small increase in the number of shares outstanding.

I take all this to mean that my original investment thesis on Cisco still stands, despite the significant drop in share price. Therefore, further purchase of shares would make sense for me, since the long-term fundamentals of the company have changed very little or not at all. I am not concerned that the stock price has dropped by around 17% from my initial entry point. I am still convinced that Cisco has great potential over the long term, and am comfortable with my conviction. I would only take a loss of 17% in value if I were to sell my shares right now, but I don't intend on doing so for a very long time yet.

Disclosure: I am long CSCO.

Mistakes made and lessons learned about personal investing and economics in Canada from the age of 22 onward

Thursday, May 10, 2012

Wednesday, May 2, 2012

Stock Analysis: Cisco Systems, Inc. (NASDAQ:CSCO)

I haven't posted a stock analysis in a long time, and I've learned a lot about fundamental analysis since my last "stock analysis". I put that in quotes because my previous analysis mainly involved the use of common ratios and how they fit into a relatively rigid dividend growth investing strategy. More recently, I have begun analyzing stocks based on their income statements, balance sheets, cash flow statements, annual reports, and proxy statements. In addition, I intend to only invest in businesses that I understand. My circle of competence is relatively small, but I am beginning to expand it by learning about a second industry. I have just recently finished a Bachelor of Computer Science degree, and so my only real area of expertise is technology. Tech stocks are unpopular with a lot of Buffett-style value investors because their competitive advantage(s) usually rely on continuous capital expenditures and research and development. With that said, it's still my best area of knowledge and I've done a thorough enough analysis that I am personally comfortable with. So without further ado, I'll dive into my analysis of Cisco Systems Inc.

If you aren't aware, Cisco Systems' core product line is the development of equipment for computer network routing and switching. The entire Internet and all private networks rely on routing and switching equipment, and Cisco is the biggest name for enterprise routing and switching, and a significant competitor in the consumer router space.

All of my numbers-oriented discussion relates to the past four years of annual financial data regarding Cisco. They would be best summarized in a bullet list:

I haven't done extensive research on the quality of Juniper Networks' router and switch products, but I would imagine that they are inferior to those of Cisco based solely on the fact that Juniper Networks has been around since before 2000 and I had never heard of them or seen any of their products in use at various software development positions I've held. This is somewhat anecdotal, but I feel that it is telling of Cisco's brand recognition and large market share.

If you aren't aware, Cisco Systems' core product line is the development of equipment for computer network routing and switching. The entire Internet and all private networks rely on routing and switching equipment, and Cisco is the biggest name for enterprise routing and switching, and a significant competitor in the consumer router space.

All of my numbers-oriented discussion relates to the past four years of annual financial data regarding Cisco. They would be best summarized in a bullet list:

- Consistent gross margin around 64%

- Consistent R&D expense around 22% of gross profit

- Consistent selling/general/admin expense around 42% of gross profit, which isn't a bad percentage

- Net income as a percentage of revenue is consistently above 15%

- Over $44 billion in cash and short-term investments

- Cash/short-term investments plus accounts receivable is consistently around 2 times current liabilities

- Four times annual net income is consistently around 2 times long term debt (could pay off all long term debt within 4 years or less, using only net income)

- Return on assets is 10% on average

- Consistent retained earnings growth

- Return on equity consistently greater than or equal to 14%

- Debt-shareholder equity ratio consistently around 0.8

- Consistent annual decline in shares outstanding by around 3%

- Capital expenditure divided by net income is 16% on average (even 25% or less is good)

- Average annual owner earnings of $8,004 million (Net income + Depreciation/Amortization - Capital expenditure)

The thing you immediately notice about this bullet list is that consistency is mentioned in almost every bullet point. That is why I focused on average values or approximate values, rather than percentage growth or decline year over year, but more on that later. Consistent cost management and return on assets/return on equity make for a pretty dependable stock. Debt is not used in excess, and is manageable in terms of being able to service the debt. Retained earnings growth, share repurchases, and lots of owner earnings are all good signs too.

Another point that I left out to talk about separately is that the company has recently begun paying a quarterly dividend. At the moment, the payout ratio is only 8%, but Cisco has more than enough owner earnings and cash to pave the way for long-term dividend growth. If I start building a position in the stock now to hold over the long term, the dividend yield-on-cost could be significant.

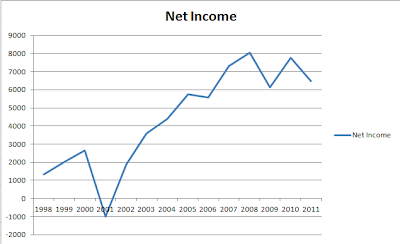

Unfortunately, revenue growth, net income growth, earnings per share growth and owner earnings growth are not consistent year over year, but they do seem to be in a long-term upward trend, despite dips every other year recently. The following chart gives a quick visual of Cisco's net income since 1998:

An investment should not be made based solely on financial statement numbers, and so I will now move on to a discussion of the company's management and macro-economic outlook. To start, I will state some quotes from Cisco's 2011 proxy statement. Out of all the corporate governance policies, three stood out to me as good elements to see in a company:

- "The independent members of the Board of Directors meet regularly without the presence of management" - This is good because there is no pressure on the board to withhold negative comments or constructive criticism of the CEO, which would be the case if he were present. It is the job of the board to evaluate the CEO and reward his performance or lack thereof accordingly.

- "Cisco has adopted a compensation recoupment policy that applies to its executive officers". Further reading in the proxy shows that this comes into effect in the case of a restatement of past financial statements. This motivates the executives to ensure honesty in the financial statements.

- "Cisco has stock ownership guidelines for its non-employee directors and executive officers". In particular, the proxy goes on to say that the CEO is required to own 5 times his base annual salary in Cisco common stock. In reality, "[the] CEO holds over 100 times his base annual salary in Cisco common stock". This means that it is in the interest of the board and the executives to put shareholder interests above all else.

I listened to Cisco's most recent fiscal year-end quarterly conference call, and found the following notes of interest:

- CEO seems to have a good grasp on the technology itself being used in Cisco's router and switch products

- "Intelligent" routers are a main focus of Cisco product development. Coming from a computer science background, I take this to mean that the "intelligence" or routing algorithms are being moved closer to the hardware (the routers themselves). This most likely leads to vast performance improvements in terms of network bandwidth and capacity.

- Cisco customers buy into an entire networking architecture. This makes it easy for customers to upgrade to newer Cisco products as they are developed, and also makes it hard for customers to switch to a different networking architecture from a rival company (due to the amount of time and money it would take).

- Data center trends are moving toward consolidation, virtualization, and private cloud services, all of which Cisco can address with its products. Having worked in software development positions for large private companies, I can see the value that a private cloud would provide for a company's internal intranet, document and source code storage, software compilation and testing, etc.

- Cisco has partnerships with VMware (the biggest virtualization software company) to accomplish these goals.

I don't simply take these statements from the conference call at face value. Because of my understanding of and background in software development and computer science, I can verify for myself that these statements make sense. This is a good example of the importance of investing in a company whose products and services you understand.

In terms of macro-economic trends that would benefit Cisco, I think that the move toward cloud services (both private and provided by 3rd-party companies such as Amazon) will continue to grow. Additionally, the move to Internet Protocol version 6 will necessitate the purchase of equipment that supports the new protocol (which Cisco routers satisfy). The internet in general is constantly growing, and its existing users are constantly demanding faster speeds and more bandwidth. In addition, mobile smartphone growth is also continuing, and network infrastructure is needed to support this growth. For these reasons, I believe that Cisco has a lot of revenue growth potential.

Cisco's closest competitors are Hewlett-Packard and Juniper Networks. I did some quick analysis on Juniper Networks, just to see how competitive they really could be with Cisco. Here are some bullet points that I found over the past 4 years of their financial data:

- R&D costs are consistently above 30% of gross profit

- Much less net income than Cisco (most recently an annual value of $425 million compared to Cisco's annual $6.5 billion)

- Negative retained earnings every year with no discernible upward trend

- Return on equity and return on assets consistently below 10%

- Higher capital expenditure as a percentage of net income on average

One concern that I have about this stock is that Cisco mainly fuels its growth through acquisitions, which can be prone to being more costly than profitable. Cisco has recently announced the end of its Flip Video product line that it acquired several years ago from another company. If many acquisitions are made over time, some of them are bound to turn out badly, to the detriment of shareholders. Luckily, management admits that things turned out badly and discontinues the product line, rather than pumping more money into it. In addition, I believe that Cisco's core router and switch product lines aren't likely to be of such poor quality that earnings will suffer in a significant way.

Finally, valuation of Cisco shares must be considered to see what kind of margin of safety exists at the current price per share. I assumed a conservative growth of owner earnings of 5% annually (although this has the potential to be much higher). Factoring in discounted cash flows over ten years, Cisco's total assets and total liabilities, I came up with a target price/intrinsic value of around $34 per share. As of this writing, Cisco shares closed at $19.84. I have initiated a position and plan to buy more if shares dip even lower in the near future.

Any thoughts on my analysis?

As always, this blog post should not be considered financial advice, and you should always do your own research before making any investment decision. Disclosure: I am long CSCO.

Edit: Click here to read some follow-up thoughts on Cisco Systems after their most recent quarterly earnings release.

As always, this blog post should not be considered financial advice, and you should always do your own research before making any investment decision. Disclosure: I am long CSCO.

Edit: Click here to read some follow-up thoughts on Cisco Systems after their most recent quarterly earnings release.

Friday, April 13, 2012

Transferring TD Mutual Fund RRSP Account to Questrade Self-Directed RRSP

About six months ago, I decided that I wanted to get more actively involved in picking individual stocks using a value investing approach and that my TD mutual fund RRSP account was not enough for me. I looked at converting to a TD Waterhouse account, but it had an annual fee of $100 and cost $30 per trade. Since I'm just starting out as an investor, I want to conserve as much money as possible, so I decided to transfer my RRSP account to a Questrade self-directed RRSP with no annual fee and only $5 per trade. I already have a TFSA trading account with Questrade and hadn't had any problems with them, so I decided it would be a good move to have my RRSP with Questrade as well.

After waiting until I could sell my TD mutual fund units without incurring an early trading fee, I moved everything to a money market fund with no early penalty fees and initiated a transfer. The first step was to open a Questrade RRSP account. You are allowed to have more than one RRSP account, you just can't contribute more than your total allowed annual contribution limit between the two accounts. I finished the Questrade RRSP application up to the point where you need to fund the account. Then I found the appropriate transfer form from Questrade's website. It will even fill out all your new account information for you, and you just need to provide the details of the relinquishing institution. I didn't need to contact TD in any way at this point.

Once Questrade initiated the transfer, they informed me that the transfer would take 10-20 business days (which translates to about a month). So I patiently began waiting, and researched stocks and read about value investing while I waited. TD and Questrade were true to their word and took the most amount of time possible before I would start to get impatient. Exactly one month plus a day, I logged on to my TD online banking and the RRSP account had been sold out and closed. I thought I might have to make a separate request with TD to close the account, but it turns out they did that for me. But when I checked Questrade, expecting to see my RRSP balance, I instead found that the transfer had been rejected.

According to Questrade, the relinquishing institution said that the account number was invalid. I found that confusing because the account was closed according to TD EasyWeb. Questrade said they could re-initiate the transfer (which would take another 10-20 business days) if I sent them an account statement with my name, address, and account number on it. I uploaded a scanned copy of the document and waited a couple more days. Nothing was changing, so I called TD. They said that my RRSP was closed and that they had no other information. So I called Questrade and told them the situation, and they looked into the problem.

Apparently the account was transferred to Penson financial (who provides holding services for Questrade), but the transfer could not be completed to Questrade because of the account number. What happened was the following. When I was filling out the transfer request form on Questrade's website, I wrote in the full 10-digit RRSP account number that I saw in TD EasyWeb. When I checked my account statement, the account number was only 7 digits. What I actually needed was just the last 7 digits, which is what caused all the trouble.

So after Questrade opened a ticket for me and reviewed my uploaded account statement, two days later I was informed that my Questrade account was funded and that I could begin trading. Before initiating the transfer over a month ago, I Google searched a bit to see what kind of transfer fees TD would charge me for moving my account to another institution. From what I found, I was expecting that TD would take about $100 from my RRSP in fees. To my delightful surprise, I found that they didn't take a cent!

So now my self-directed RRSP with Questrade is funded, and I'm ready to do some value investing!

After waiting until I could sell my TD mutual fund units without incurring an early trading fee, I moved everything to a money market fund with no early penalty fees and initiated a transfer. The first step was to open a Questrade RRSP account. You are allowed to have more than one RRSP account, you just can't contribute more than your total allowed annual contribution limit between the two accounts. I finished the Questrade RRSP application up to the point where you need to fund the account. Then I found the appropriate transfer form from Questrade's website. It will even fill out all your new account information for you, and you just need to provide the details of the relinquishing institution. I didn't need to contact TD in any way at this point.

Once Questrade initiated the transfer, they informed me that the transfer would take 10-20 business days (which translates to about a month). So I patiently began waiting, and researched stocks and read about value investing while I waited. TD and Questrade were true to their word and took the most amount of time possible before I would start to get impatient. Exactly one month plus a day, I logged on to my TD online banking and the RRSP account had been sold out and closed. I thought I might have to make a separate request with TD to close the account, but it turns out they did that for me. But when I checked Questrade, expecting to see my RRSP balance, I instead found that the transfer had been rejected.

According to Questrade, the relinquishing institution said that the account number was invalid. I found that confusing because the account was closed according to TD EasyWeb. Questrade said they could re-initiate the transfer (which would take another 10-20 business days) if I sent them an account statement with my name, address, and account number on it. I uploaded a scanned copy of the document and waited a couple more days. Nothing was changing, so I called TD. They said that my RRSP was closed and that they had no other information. So I called Questrade and told them the situation, and they looked into the problem.

Apparently the account was transferred to Penson financial (who provides holding services for Questrade), but the transfer could not be completed to Questrade because of the account number. What happened was the following. When I was filling out the transfer request form on Questrade's website, I wrote in the full 10-digit RRSP account number that I saw in TD EasyWeb. When I checked my account statement, the account number was only 7 digits. What I actually needed was just the last 7 digits, which is what caused all the trouble.

So after Questrade opened a ticket for me and reviewed my uploaded account statement, two days later I was informed that my Questrade account was funded and that I could begin trading. Before initiating the transfer over a month ago, I Google searched a bit to see what kind of transfer fees TD would charge me for moving my account to another institution. From what I found, I was expecting that TD would take about $100 from my RRSP in fees. To my delightful surprise, I found that they didn't take a cent!

So now my self-directed RRSP with Questrade is funded, and I'm ready to do some value investing!

Monday, March 19, 2012

Hasbro Share Repurchasing: Follow-Up

Back in February, I wrote a blog post about Hasbro Inc.'s use of free cash flow to repurchase shares, and how sometimes the amount of shares repurchased approached or exceeded the company's free cash flow. I'll admit that I initially panicked at my findings, as I was about to make a purchase of Hasbro shares. On the advice of a friend, I did some further investigating on the issue, and I am now writing this blog post to summarize my findings.

I spoke with Hasbro investor relations, and they were very helpful in providing me with details of Hasbro's policies on use of free cash flow. Hasbro generates a healthy amount of cash, and there are multiple options for what to do with that cash. According to investor relations, Hasbro's first priority is to reinvest in the business, typically in the order of tens of millions of dollars. Acquisitions are an option, however they are not typically pursued as the value obtained is not sufficient, but intellectual property is sometimes purchased. Cash could be used to pay down debt, however Hasbro makes use of "good debt" that is manageable and adds to the business's ability to operate. If you take a look at Hasbro's annual balance sheets, their total current liabilities are typically less than their total long-term debt.

At Hasbro, it is a tradition to return cash to shareholders. Hasbro has maintained or increased their quarterly dividend every year since 2002. Hasbro has been buying back shares for a long time, and continues to do so under their current authorization since 2005. Hasbro's reason for buying back shares is to offset dilution of shareholder value as a result of stock-based compensation of management, and to buy back shares over and above that offset in order to increase shareholder value. Hasbro does so opportunistically to take advantage of low share pricing at times. Typically in the past and going forward, Hasbro does not use debt to repurchase shares.

If you look at the table in my last blog post, the only year in which Hasbro spent more than 100% of their free cash flow to repurchase shares was 2010. According to investor relations, this was to offset the conversion of a convertible debt offering issued in 2001 into common stock. Hasbro's net change in cash for 2010 was +$91.75 million, even though it repurchased $546 million of common stock. Hasbro also took on debt that year to raise cash. I had read through multiple annual reports dating back to 1997 from Hasbro in search of why this particular year was so aggressive in terms of share repurchases. I found multiple references to convertible debentures and share repurchases, but I did not find any mention of their connection to each other.

In terms of whether Hasbro believed its shares to be undervalued when purchasing them, the only answer I found was an average price quote for a time period that I should have written down but must have missed, and that purchases were opportunistic.

All in all, I've accomplished some in-depth research on Hasbro, and it was my first time calling the investor relations department of a public company. Hasbro seems to care about share dilution and seems dedicated to returning cash to shareholders, while growing its core brands and operations. I'll mull over Hasbro a little longer, but I don't want to over-analyze it.

I spoke with Hasbro investor relations, and they were very helpful in providing me with details of Hasbro's policies on use of free cash flow. Hasbro generates a healthy amount of cash, and there are multiple options for what to do with that cash. According to investor relations, Hasbro's first priority is to reinvest in the business, typically in the order of tens of millions of dollars. Acquisitions are an option, however they are not typically pursued as the value obtained is not sufficient, but intellectual property is sometimes purchased. Cash could be used to pay down debt, however Hasbro makes use of "good debt" that is manageable and adds to the business's ability to operate. If you take a look at Hasbro's annual balance sheets, their total current liabilities are typically less than their total long-term debt.

At Hasbro, it is a tradition to return cash to shareholders. Hasbro has maintained or increased their quarterly dividend every year since 2002. Hasbro has been buying back shares for a long time, and continues to do so under their current authorization since 2005. Hasbro's reason for buying back shares is to offset dilution of shareholder value as a result of stock-based compensation of management, and to buy back shares over and above that offset in order to increase shareholder value. Hasbro does so opportunistically to take advantage of low share pricing at times. Typically in the past and going forward, Hasbro does not use debt to repurchase shares.

If you look at the table in my last blog post, the only year in which Hasbro spent more than 100% of their free cash flow to repurchase shares was 2010. According to investor relations, this was to offset the conversion of a convertible debt offering issued in 2001 into common stock. Hasbro's net change in cash for 2010 was +$91.75 million, even though it repurchased $546 million of common stock. Hasbro also took on debt that year to raise cash. I had read through multiple annual reports dating back to 1997 from Hasbro in search of why this particular year was so aggressive in terms of share repurchases. I found multiple references to convertible debentures and share repurchases, but I did not find any mention of their connection to each other.

In terms of whether Hasbro believed its shares to be undervalued when purchasing them, the only answer I found was an average price quote for a time period that I should have written down but must have missed, and that purchases were opportunistic.

All in all, I've accomplished some in-depth research on Hasbro, and it was my first time calling the investor relations department of a public company. Hasbro seems to care about share dilution and seems dedicated to returning cash to shareholders, while growing its core brands and operations. I'll mull over Hasbro a little longer, but I don't want to over-analyze it.

Sunday, March 18, 2012

An Austrian School Contradiction: Revisited

In my previous blog post about Austrian School beliefs regarding price fixing and the gold standard, I described how fixing the rate of change in price is essentially the same as setting simultaneous floor and ceiling prices. This is technically untrue, since a rate of change implies the involvement of a time variable, however my floor and ceiling price limits have nothing to do with time. In other words, the price of a good can fluctuate between those price limits as quickly or as slowly as it may. All the price limits accomplish are a minimum and maximum absolute value difference between a good's starting price and its ending price, whichever point in time that may be.

Price limits aside, I was reading through a blog post on Mises.org ("Is Inflation about General Increases in Prices?") and realized that I may have misinterpreted some Austrian School beliefs, as I suspected I might have at the end of the last blog post.

The key difference that I failed to distinguish previously was that inflation is dilution of the money supply, not an increase in size of the money supply. For example, if gold is the medium of exchange in an economy and someone mines more gold, he is participating in the market's demand for gold. If he decides to cheat and dilute the money supply by melting down gold coins and reproducing them with less gold content, or by printing extra gold recipts (paper money), this person would be using the new "money" to buy something for nothing. In other words, he did not exchange wealth for wealth, he exchanged nothing for welath, which leads to a misallocation of resources in the economy.

This one paragraph doesn't do the concept justice, so I suggest you read through the original Mises.org article. In conclusion, Austrian School advocates of a gold standard aren't trying to regulate the size of the money supply; they are trying to control dilution of the money supply. Having real gold as the medium of exchange makes it much more difficult (although not impossible) to dilute the money supply than if the medium of exchange were a fiat currency (as we have today).

Price limits aside, I was reading through a blog post on Mises.org ("Is Inflation about General Increases in Prices?") and realized that I may have misinterpreted some Austrian School beliefs, as I suspected I might have at the end of the last blog post.

The key difference that I failed to distinguish previously was that inflation is dilution of the money supply, not an increase in size of the money supply. For example, if gold is the medium of exchange in an economy and someone mines more gold, he is participating in the market's demand for gold. If he decides to cheat and dilute the money supply by melting down gold coins and reproducing them with less gold content, or by printing extra gold recipts (paper money), this person would be using the new "money" to buy something for nothing. In other words, he did not exchange wealth for wealth, he exchanged nothing for welath, which leads to a misallocation of resources in the economy.

This one paragraph doesn't do the concept justice, so I suggest you read through the original Mises.org article. In conclusion, Austrian School advocates of a gold standard aren't trying to regulate the size of the money supply; they are trying to control dilution of the money supply. Having real gold as the medium of exchange makes it much more difficult (although not impossible) to dilute the money supply than if the medium of exchange were a fiat currency (as we have today).

Tuesday, February 28, 2012

Giving Cash Back To Shareholders is Nice... When You Can Afford It

Over the past few weeks, I've been looking at various stocks trying to find my very first Warren Buffett-style value investing stock pick. One of my main considerations was Hasbro, Inc. Hasbro has a lot of brand power under their belts: Monopoly, Battleship, Boggle, Pictionary, Risk, Scrabble, Trivial Pursuit, Transformers, Nerf, not to mention more targeted brands such as Magic: The Gathering and Dungeons and Dragons. I went to Zellers the other day and took a stroll through the toy section. Many of the toys were made by Hasbro, meaning that Hasbro has a lot of retail store shelf space at stores like Wal-Mart, Zellers, Toys R Us, and so on. Hasbro has also been diversifying their brands toward movie production, such as Transformers and G.I. Joe. Upon examining the management, I found that the CEO of Hasbro personally heads the Corporate Social Responsibility Committee, a task that could easily have been delegated to a sub-manager. To me, that shows that the CEO actually cares about what goes on at those committee meetings.

When considering Hasbro's financials, I found a lot that matched a checklist I've built, based on reading how value investors like Warren Buffett pick stocks. Hasbro has low capital expenditure, consistent profit margins, return on assets in the 9-10% range, growth in net income and growth in what Buffett calls "owner earnings". Owner earnings, or free cash flow, are equal to the company's net income, plus depreciation/amortization, minus capital expenditures. Since depreciation/amortization are a non-cash expense, the cost is added back in to the equation, and offsetting depreciation/amortization is taken into account by subtracting capital expenditures. The result is the amount of cash that the company can decide to re-invest in the business, use to acquire other companies, or pay out to shareholders in the form of dividends or share repurchases.

Something Buffett likes to see in a stock is good treatment of shareholders. At the time of this writing, Hasbro currently has a dividend yield of just over 4%, which is pretty good. They also have an on-going share repurchase program. Since 2008, Hasbro has repurchased about 10.6 million shares. The result has been a steady increase in earnings per share. After valuing Hasbro's future cash flows with a modest 5% growth per year, I came up with a valuation of the company that is higher than its current share price, offering a margin of safety around 25%. If I were to assume a higher growth rate, that margin of safety would be larger, but I don't want to over-estimate. In any case, I had all but convinced myself that this stock would be a good buy, according to the value investing principles I have been learning about. The only reason I haven't purchased this stock yet is that I'm still waiting on transferring my RRSP account over to a self-directed account that I can use to buy individual stocks. Perhaps this was a blessing in disguise.

Buffett says that when you find a good investment, you should place a sizeable chunk of cash on it. Since I would be placing a sizeable chunk of cash on Hasbro, I want to be sure that I'm right about its prospects. After all, the whole strategy of focus investing is simply to just buy good companies, and avoid bad ones. I wanted to make sure I wasn't buying a bad one. It seemed strange to me that shareholders were being so lavishly rewarded year after year with dividend payouts and share repurchases, when news pieces on Hasbro had such a modest or grim outlook. I whipped up a quick spreadsheet, and here is what I found:

From what I see in the spreadsheet, Hasbro has been paying out more than 100% of its owner earnings to shareholders! At the same time, it has been borrowing hundreds of millions each year. It looks to me like this is unsustainable. Cash should only be paid out to shareholders if it can't be better used elsewhere to grow the company and add value for shareholders. From what I can tell, at least some of the cash being borrowed and/or paid out to shareholders could probably be better used by re-investing in the business. This realization has led me to reconsider my plans to purchase shares in Hasbro for the time being.

Edit: I did some follow-up research on this topic, and wrote a blog post summarizing my findings.

When considering Hasbro's financials, I found a lot that matched a checklist I've built, based on reading how value investors like Warren Buffett pick stocks. Hasbro has low capital expenditure, consistent profit margins, return on assets in the 9-10% range, growth in net income and growth in what Buffett calls "owner earnings". Owner earnings, or free cash flow, are equal to the company's net income, plus depreciation/amortization, minus capital expenditures. Since depreciation/amortization are a non-cash expense, the cost is added back in to the equation, and offsetting depreciation/amortization is taken into account by subtracting capital expenditures. The result is the amount of cash that the company can decide to re-invest in the business, use to acquire other companies, or pay out to shareholders in the form of dividends or share repurchases.

Something Buffett likes to see in a stock is good treatment of shareholders. At the time of this writing, Hasbro currently has a dividend yield of just over 4%, which is pretty good. They also have an on-going share repurchase program. Since 2008, Hasbro has repurchased about 10.6 million shares. The result has been a steady increase in earnings per share. After valuing Hasbro's future cash flows with a modest 5% growth per year, I came up with a valuation of the company that is higher than its current share price, offering a margin of safety around 25%. If I were to assume a higher growth rate, that margin of safety would be larger, but I don't want to over-estimate. In any case, I had all but convinced myself that this stock would be a good buy, according to the value investing principles I have been learning about. The only reason I haven't purchased this stock yet is that I'm still waiting on transferring my RRSP account over to a self-directed account that I can use to buy individual stocks. Perhaps this was a blessing in disguise.

Buffett says that when you find a good investment, you should place a sizeable chunk of cash on it. Since I would be placing a sizeable chunk of cash on Hasbro, I want to be sure that I'm right about its prospects. After all, the whole strategy of focus investing is simply to just buy good companies, and avoid bad ones. I wanted to make sure I wasn't buying a bad one. It seemed strange to me that shareholders were being so lavishly rewarded year after year with dividend payouts and share repurchases, when news pieces on Hasbro had such a modest or grim outlook. I whipped up a quick spreadsheet, and here is what I found:

|

| Data taken from Google Finance |

Edit: I did some follow-up research on this topic, and wrote a blog post summarizing my findings.

Wednesday, January 4, 2012

Book Review: Warren Buffett and the Interpretation of Financial Statements

On the advice of a friend, I just recently purchased a book on how to read and interpret financial statements (income statements, balance sheets, and cash flow statements) for publicly-traded companies. Since I wanted to learn how to read these statements in the context of Warren Buffett's style of investing, I found the perfect title: Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive Advantage.

The book is a short one, weighing in at only 175 pages of reading. It also includes appendices containing model financial statements, an index, and a particularly useful glossary that not only defines a list of financial terms, but also explains the term's significance when it comes to finding signs of a durable competitive advantage in a company. The book goes through each type of financial statement, line by line, and explains its meaning, possible abuses, and usefulness in determining the health and advantages of a company. After each financial statement is covered, the book also has a few chapters on valuation of stocks, Buffett's equity-bond theory, and when to buy and sell a stock in Buffett style.

Overall, I've found this to be a helpful book that has expanded my knowledge of fundamental analysis of companies. It was an easy and informative read; I ended up finishing it in under 24 hours (which is saying a lot for me!) After reading the book, I summarized what I had learned by skimming each chapter over again and creating a Word document that contains a checklist of things to look for in financial statements when searching for whether a company has a durable competitive advantage.

I currently only own one stock position (it's been almost 4 months since I bought it) that I had researched a fair amount at the time of purchase. Armed with my new and deeper knowledge of financial statements, I did another analysis of the stock's financial statements based on my new checklist. Happily, the stock passes nearly all the line items on my checklist. This has renewed my resolve to hold on to the stock for a long period of time. However, good financials and a bargain price are not the only things Buffett relies on to become so wealthy. Warren Buffett is a believer in investing inside one's own "circle of competence", or "invest in what you know". The stock I own is a uranium mining company. Admittedly, I know very little about uranium mining, the accompanying industry, competition or external factors that can influence the company whose shares I own. In any case, I will hold on to my stock regardless and hope for the best, but in the future I plan on investing within my circle of competence. As Warren Buffett once said, "You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital."

Coming back to the book review, I would definitely add this book to my list of recommended reading. It remains to be seen how financially beneficial this book will be to me in the future, but my guess is that it will be greatly valuable.

To buy the book from Amazon, click the link below. If all you can see is an Amazon ad, just refresh this page. Disclaimer: If you do so, I will earn a small commission.

The book is a short one, weighing in at only 175 pages of reading. It also includes appendices containing model financial statements, an index, and a particularly useful glossary that not only defines a list of financial terms, but also explains the term's significance when it comes to finding signs of a durable competitive advantage in a company. The book goes through each type of financial statement, line by line, and explains its meaning, possible abuses, and usefulness in determining the health and advantages of a company. After each financial statement is covered, the book also has a few chapters on valuation of stocks, Buffett's equity-bond theory, and when to buy and sell a stock in Buffett style.

Overall, I've found this to be a helpful book that has expanded my knowledge of fundamental analysis of companies. It was an easy and informative read; I ended up finishing it in under 24 hours (which is saying a lot for me!) After reading the book, I summarized what I had learned by skimming each chapter over again and creating a Word document that contains a checklist of things to look for in financial statements when searching for whether a company has a durable competitive advantage.

I currently only own one stock position (it's been almost 4 months since I bought it) that I had researched a fair amount at the time of purchase. Armed with my new and deeper knowledge of financial statements, I did another analysis of the stock's financial statements based on my new checklist. Happily, the stock passes nearly all the line items on my checklist. This has renewed my resolve to hold on to the stock for a long period of time. However, good financials and a bargain price are not the only things Buffett relies on to become so wealthy. Warren Buffett is a believer in investing inside one's own "circle of competence", or "invest in what you know". The stock I own is a uranium mining company. Admittedly, I know very little about uranium mining, the accompanying industry, competition or external factors that can influence the company whose shares I own. In any case, I will hold on to my stock regardless and hope for the best, but in the future I plan on investing within my circle of competence. As Warren Buffett once said, "You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital."

Coming back to the book review, I would definitely add this book to my list of recommended reading. It remains to be seen how financially beneficial this book will be to me in the future, but my guess is that it will be greatly valuable.

To buy the book from Amazon, click the link below. If all you can see is an Amazon ad, just refresh this page. Disclaimer: If you do so, I will earn a small commission.

Subscribe to:

Posts (Atom)